FOR 401k professionals

The missing link between workplace savings and long-term growth.

Deliver participant advocacy that hyper-drives loyalty

Turn engagement into measurable growth

Sponsor-ready insights that demonstrate fiduciary care

FOR 401k professionals

The missing link between workplace savings and long-term growth.

Deliver participant advocacy that hyper-drives loyalty

Turn engagement into measurable growth

Sponsor-ready insights that demonstrate fiduciary care

FOR 401k professionals

The missing link between workplace savings and long-term growth.

Deliver participant advocacy that hyper-drives loyalty

Turn engagement into measurable growth

Sponsor-ready insights that demonstrate fiduciary care

The challenge

You can’t grow the opportunity if you only see the 401(k).

2-3x

Higher engagement driven by personalized insight

source: Truthifi internal data/research

$1.5T

Rollover-ready assets that are sitting idle in old plans

Source: Capitalize Department of Labor data and industry analysis (2023–2024)

78%

People want a unified view of their finances, but only 29% have it

Source: Industry research (Accenture / PwC / EY consumer financial engagement surveys)

The challenge

You can’t grow the opportunity if you only see the 401(k).

2-3x

Higher engagement driven by personalized insight

source: Truthifi internal data/research

$1.5T

Rollover-ready assets that are sitting idle in old plans

Source: Capitalize Department of Labor data and industry analysis (2023–2024)

78%

People want a unified view of their finances, but only 29% have it

Source: Industry research (Accenture / PwC / EY consumer financial engagement surveys)

The challenge

You can’t grow the opportunity if you only see the 401(k).

2-3x

Higher engagement driven by personalized insight

source: Truthifi internal data/research

$1.5T

Rollover-ready assets that are sitting idle in old plans

Source: Capitalize Department of Labor data and industry analysis (2023–2024)

78%

People want a unified view of their finances, but only 29% have it

Source: Industry research (Accenture / PwC / EY consumer financial engagement surveys)

How it works

Better outcomes. Participant + revenue growth.

1

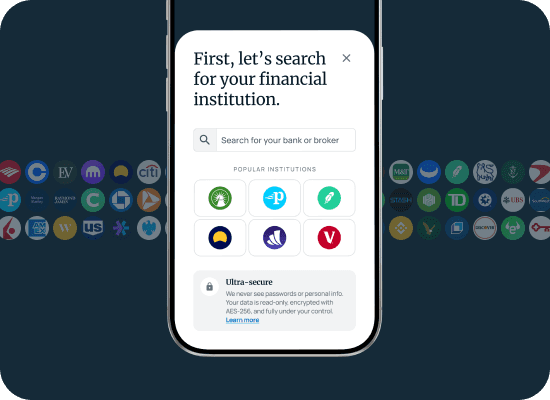

Connect.

Participants link key accounts beyond the plan.

2

Understand.

Truthifi continuously analyzes the full financial picture.

3

Engage

Targeted insights and prompts drive automated action.

4

Prove.

Sponsors see measurable trends and documented progress.

How it works

Better outcomes. Participant + revenue growth.

1

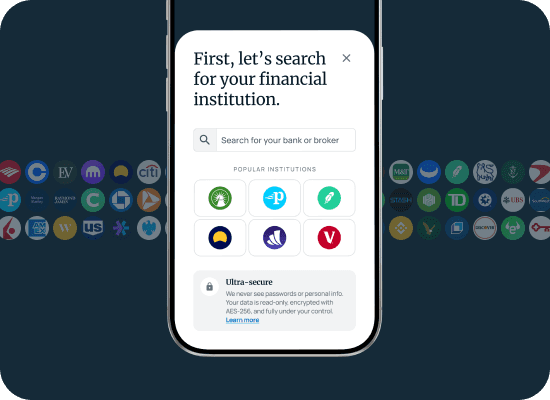

Connect.

Participants link key accounts beyond the plan.

2

Understand.

Truthifi continuously analyzes the full financial picture.

3

Engage

Targeted insights and prompts drive automated action.

4

Prove.

Sponsors see measurable trends and documented progress.

How it works

Better outcomes. Participant + revenue growth.

1

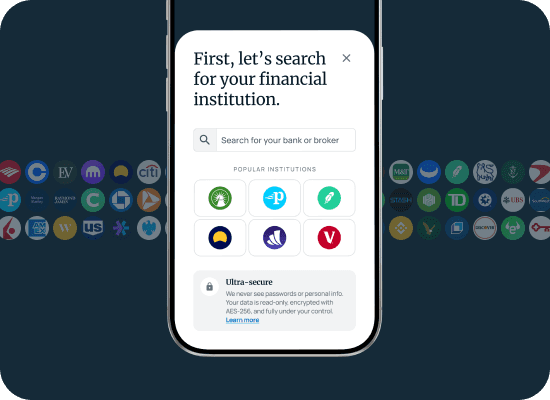

Connect.

Participants link key accounts beyond the plan.

2

Understand.

Truthifi continuously analyzes the full financial picture.

3

Engage

Targeted insights and prompts drive automated action.

4

Prove.

Sponsors see measurable trends and documented progress.

What we deliver

Better outcomes & greater visibility—at scale.

Beyond-the-plan visibility.

See the full financial context driving participant behavior, including debt, cash flow, outside savings, and competing priorities.

Off-track participant detection.

Identify participants who are not using the match, have low savings rates, or have improper allocations.

Plan sponsor dashboard.

Monitor aggregate financial health, engagement trends, and outcome signals across the plan—without exposing individual participant data.

Participant communications.

Automated nudges and the monthly podcast statement help participants understand their complete financial picture and take informed action.

What we deliver

Better outcomes & greater visibility—at scale.

Beyond-the-plan visibility.

See the full financial context driving participant behavior, including debt, cash flow, outside savings, and competing priorities.

Off-track participant detection.

Identify participants who are not using the match, have low savings rates, or have improper allocations.

Plan sponsor dashboard.

Monitor aggregate financial health, engagement trends, and outcome signals across the plan—without exposing individual participant data.

Participant communications.

Automated nudges and the monthly podcast statement help participants understand their complete financial picture and take informed action.

What we deliver

Better outcomes & greater visibility—at scale.

Beyond-the-plan visibility.

See the full financial context driving participant behavior, including debt, cash flow, outside savings, and competing priorities.

Off-track participant detection.

Identify participants who are not using the match, have low savings rates, or have improper allocations.

Plan sponsor dashboard.

Monitor aggregate financial health, engagement trends, and outcome signals across the plan—without exposing individual participant data.

Participant communications.

Automated nudges and the monthly podcast statement help participants understand their complete financial picture and take informed action.

The truthifi® advantage

Plan engagement that goes beyond contribution rates.

Improved participant outcomes

Participants make better decisions when their full financial context is visible—reducing leakage and improving long-term readiness.

Participant advocacy vs. selling

Provide participants with engagement tools that foster loyalty.

Documented fiduciary confidence

Continuous monitoring and engagement tracking create a clear, defensible record of fiduciary care.

Strong sponsor trust

Sponsors gain visibility into what’s working—building confidence in plan design, engagement strategy, and advisor value.

The truthifi® advantage

Plan engagement that goes beyond contribution rates.

Improved participant outcomes

Participants make better decisions when their full financial context is visible—reducing leakage and improving long-term readiness.

Participant advocacy vs. selling

Provide participants with engagement tools that foster loyalty.

Documented fiduciary confidence

Continuous monitoring and engagement tracking create a clear, defensible record of fiduciary care.

Strong sponsor trust

Sponsors gain visibility into what’s working—building confidence in plan design, engagement strategy, and advisor value.

The truthifi® advantage

Plan engagement that goes beyond contribution rates.

Improved participant outcomes

Participants make better decisions when their full financial context is visible—reducing leakage and improving long-term readiness.

Participant advocacy vs. selling

Provide participants with engagement tools that foster loyalty.

Documented fiduciary confidence

Continuous monitoring and engagement tracking create a clear, defensible record of fiduciary care.

Strong sponsor trust

Sponsors gain visibility into what’s working—building confidence in plan design, engagement strategy, and advisor value.

When you see beyond the plan, you can improve outcomes—and prove you did.

When you see beyond the plan, you can improve outcomes—and prove you did.

When you see beyond the plan, you can improve outcomes—and prove you did.

Leadership

Built by people who know financial systems.

Scott Blandford

ceo & founder

After 25 years at TIAA, Fidelity, and Merrill, he founded Truthifi to make the global investment system legible for the first time.

Rich Aneser

strategy & partnerships

Having led strategy and marketing for 25+ years, from Fidelity to Merrill Lynch to Envestnet, he knows how firms and clients interact—and how to make it better.

Mike Young

head of product

A senior product and design leader with more than a decade shaping digital experiences at Merrill, he brings institutional product rigor to Truthifi.

Nathan Knight

head of engineering

Trained in computer science at the University of Waterloo and battle-tested at ConsenSys, he has built and owned several complex systems end to end.

Leadership

Built by people who know financial systems.

Scott Blandford

ceo & founder

After 25 years at TIAA, Fidelity, and Merrill, he founded Truthifi to make the global investment system legible for the first time.

Rich Aneser

strategy & partnerships

Having led strategy and marketing for 25+ years, from Fidelity to Merrill Lynch to Envestnet, he knows how firms and clients interact—and how to make it better.

Mike Young

head of product

A senior product and design leader with more than a decade shaping digital experiences at Merrill, he brings institutional product rigor to Truthifi.

Nathan Knight

head of engineering

Trained in computer science at the University of Waterloo and battle-tested at ConsenSys, he has built and owned several complex systems end to end.

Leadership

Built by people who know financial systems.

Scott Blandford

ceo & founder

After 25 years at TIAA, Fidelity, and Merrill, he founded Truthifi to make the global investment system legible for the first time.

Rich Aneser

strategy & partnerships

Having led strategy and marketing for 25+ years, from Fidelity to Merrill Lynch to Envestnet, he knows how firms and clients interact—and how to make it better.

Mike Young

head of product

A senior product and design leader with more than a decade shaping digital experiences at Merrill, he brings institutional product rigor to Truthifi.

Nathan Knight

head of engineering

Trained in computer science at the University of Waterloo and battle-tested at ConsenSys, he has built and owned several complex systems end to end.

Our advisors

Roger Ferguson

Former Fed Vice Chair, CEO TIAA

Steve Jenks

CMO, Empower

Bill Crager

CEO, Founded Envestnet

Anton Honikman

CEO MyVest

Dan Petrozzo

Serial founder, VC, Goldman & Fidelity CIO

Our advisors

Roger Ferguson

Former Fed Vice Chair, CEO TIAA

Steve Jenks

CMO, Empower

Bill Crager

CEO, Founded Envestnet

Anton Honikman

CEO MyVest

Dan Petrozzo

Serial founder, VC, Goldman & Fidelity CIO

Our advisors

Roger Ferguson

Former Fed Vice Chair, CEO TIAA

Steve Jenks

CMO, Empower

Bill Crager

CEO, Founded Envestnet

Anton Honikman

CEO MyVest

Dan Petrozzo

Serial founder, VC, Goldman & Fidelity CIO

See beyond the plan. Improve outcomes with confidence.

800,000,000+

Monitored

18,000+

Providers covered

Bank-grade

Security

Who we serve

Company

Legal

See beyond the plan. Improve outcomes with confidence.

800,000,000+

Monitored

18,000+

Providers covered

Bank-grade

Security

Who we serve

Company

Legal

See beyond the plan. Improve outcomes with confidence.

800,000,000+

Monitored

18,000+

Providers covered

Bank-grade

Security

Who we serve

Company

Legal