FOR wealth management firms

Help your advisors beat competitors and win more lifetime value.

See, act & grow with held-away assets—every day

Accelerate organic growth from existing clients

Your brand experience, our engine

FOR wealth management firms

Help your advisors beat competitors and win more lifetime value.

See, act & grow with held-away assets—every day

Accelerate organic growth from existing clients

Your brand experience, our engine

FOR wealth management firms

Help your advisors beat competitors and win more lifetime value.

See, act & grow with held-away assets—every day

Accelerate organic growth from existing clients

Your brand experience, our engine

The challenge

You can’t see a significant share of your clients’ wealth—and it’s costing you.

10-12

Number of held-away accounts in the average household, preventing you from knowing their full picture

Source: synthesis of Federal Reserve Survey of Consumer Finances, FDIC, and Experian data

95%

Advisors surveyed say that clients ask them for advice on held-away assets—but most firms lack integrated visibility.

Source: Fiserv Advisor Research

75%

U.S. respondents who work with a financial advisor either switched advisors or contemplated doing so in 2023

Source: Cerulli Associates

The challenge

You can’t see a significant share of your clients’ wealth—and it’s costing you.

10-12

Number of held-away accounts in the average household, preventing you from knowing their full picture

Source: synthesis of Federal Reserve Survey of Consumer Finances, FDIC, and Experian data

95%

Advisors surveyed say that clients ask them for advice on held-away assets—but most firms lack integrated visibility.

Source: Fiserv Advisor Research

75%

U.S. respondents who work with a financial advisor either switched advisors or contemplated doing so in 2023

Source: Cerulli Associates

The challenge

You can’t see a significant share of your clients’ wealth—and it’s costing you.

10-12

Number of held-away accounts in the average household, preventing you from knowing their full picture

Source: synthesis of Federal Reserve Survey of Consumer Finances, FDIC, and Experian data

95%

Advisors surveyed say that clients ask them for advice on held-away assets—but most firms lack integrated visibility.

Source: Fiserv Advisor Research

75%

U.S. respondents who work with a financial advisor either switched advisors or contemplated doing so in 2023

Source: Cerulli Associates

How it works

Complete household views. Measurable firm-wide impact.

1

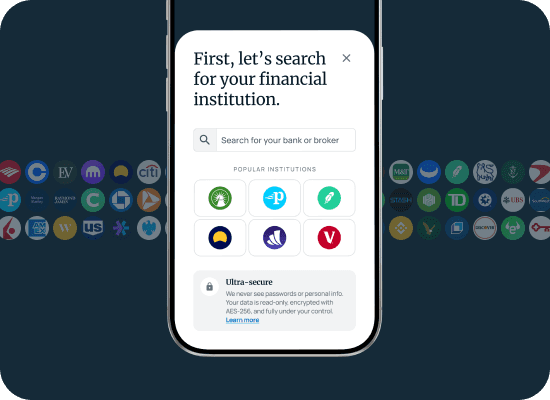

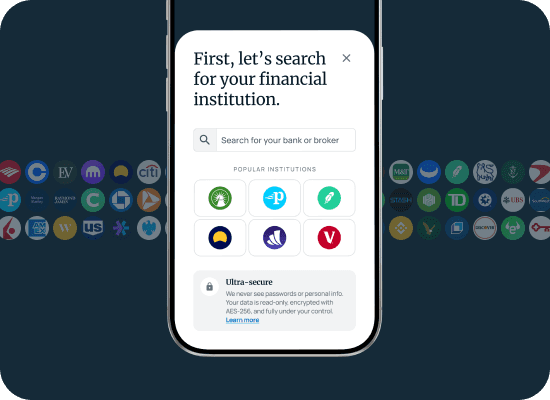

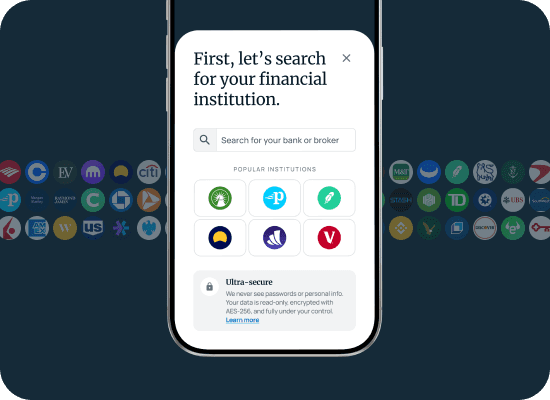

Connect.

Clients link and share more with advisors—a collaborative brand experience.

2

Monitor.

Truthifi continuously analyzes household data across the household, advisor book, and firm.

3

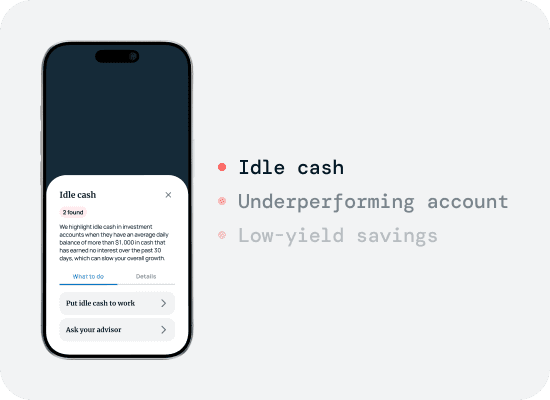

Surface.

Opportunities, risks, and supervision signals are identified automatically.

4

Act.

Advisors engage with confidence while leadership tracks consistency and outcomes.

How it works

Complete household views. Measurable firm-wide impact.

1

Connect.

Clients link and share more with advisors—a collaborative brand experience.

2

Monitor.

Truthifi continuously analyzes household data across the household, advisor book, and firm.

3

Surface.

Opportunities, risks, and supervision signals are identified automatically.

4

Act.

Advisors engage with confidence while leadership tracks consistency and outcomes.

How it works

Complete household views. Measurable firm-wide impact.

1

Connect.

Clients link and share more with advisors—a collaborative brand experience.

2

Monitor.

Truthifi continuously analyzes household data across the household, advisor book, and firm.

3

Surface.

Opportunities, risks, and supervision signals are identified automatically.

4

Act.

Advisors engage with confidence while leadership tracks consistency and outcomes.

What we deliver

Turn every advisor into an organic growth engine—automatically.

Complete Household BoR

Continuous monitoring across every household, advisor, and custodian—a total and continuous picture.

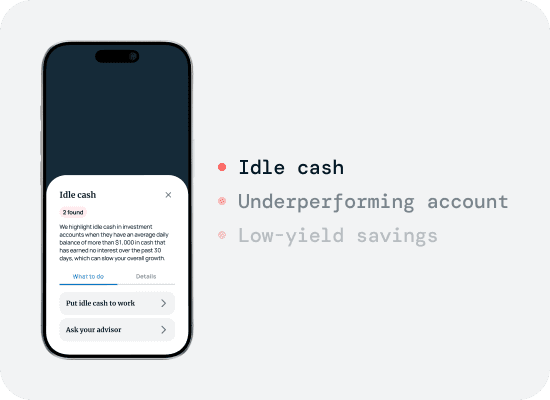

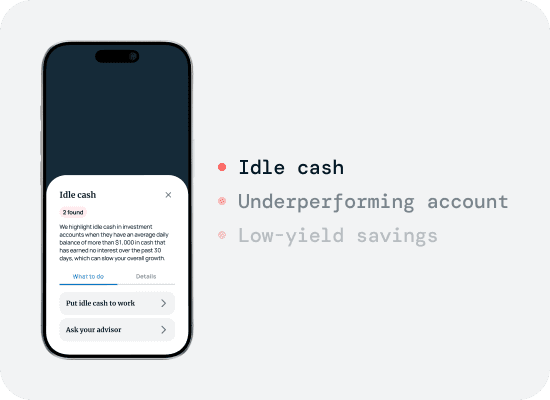

Penetrating insights to action.

100+ diagnostics across performance, fees, tax exposure, concentration, liquidity, and spending—that drive money movement.

Seamless integration.

No friction with your current tech stack, no new workflows, and no new software to learn.

Automated prompts = less work.

Firm-approved, advisor-controlled action, consolidation and statement reporting—including held-away.

What we deliver

Turn every advisor into an organic growth engine—automatically.

Complete Household BoR

Continuous monitoring across every household, advisor, and custodian—a total and continuous picture.

Penetrating insights to action.

100+ diagnostics across performance, fees, tax exposure, concentration, liquidity, and spending—that drive money movement.

Seamless integration.

No friction with your current tech stack, no new workflows, and no new software to learn.

Automated prompts = less work.

Firm-approved, advisor-controlled action, consolidation and statement reporting—including held-away.

What we deliver

Turn every advisor into an organic growth engine—automatically.

Complete Household BoR

Continuous monitoring across every household, advisor, and custodian—a total and continuous picture.

Penetrating insights to action.

100+ diagnostics across performance, fees, tax exposure, concentration, liquidity, and spending—that drive money movement.

Seamless integration.

No friction with your current tech stack, no new workflows, and no new software to learn.

Automated prompts = less work.

Firm-approved, advisor-controlled action, consolidation and statement reporting—including held-away.

The truthifi® advantage

A complete and seamless “Capture to Action” growth engine

2x higher account link rates

Users connect twice as many accounts to Truthifi compared to traditional aggregation tools.

From capture → action, in one system

Higher link rates, better insights, better meetings, and better outcomes—and less work.

Continuous household visibility

Once accounts are linked, Truthifi monitors them continuously—with real-time actions for your advisor.

Actionable held-away intelligence

100+ AI-powered diagnostics turn held-away data into actions across performance, concentrations, and more. One system that fits your tech stack and workflow.

The truthifi® advantage

A complete and seamless “Capture to Action” growth engine

2x higher account link rates

Users connect twice as many accounts to Truthifi compared to traditional aggregation tools.

From capture → action, in one system

Higher link rates, better insights, better meetings, and better outcomes—and less work.

Continuous household visibility

Once accounts are linked, Truthifi monitors them continuously—with real-time actions for your advisor.

Actionable held-away intelligence

100+ AI-powered diagnostics turn held-away data into actions across performance, concentrations, and more. One system that fits your tech stack and workflow.

The truthifi® advantage

A complete and seamless “Capture to Action” growth engine

2x higher account link rates

Users connect twice as many accounts to Truthifi compared to traditional aggregation tools.

From capture → action, in one system

Higher link rates, better insights, better meetings, and better outcomes—and less work.

Continuous household visibility

Once accounts are linked, Truthifi monitors them continuously—with real-time actions for your advisor.

Actionable held-away intelligence

100+ AI-powered diagnostics turn held-away data into actions across performance, concentrations, and more. One system that fits your tech stack and workflow.

One household view. Full product delivery. Continuous visibility into every opportunity and risk.

One household view. Full product delivery. Continuous visibility into every opportunity and risk.

One household view. Full product delivery. Continuous visibility into every opportunity and risk.

Leadership

Built by people who know financial systems.

Scott Blandford

ceo & founder

After 25 years at TIAA, Fidelity, and Merrill, he founded Truthifi to make the global investment system legible for the first time.

Rich Aneser

strategy & partnerships

Having led strategy and marketing for 25+ years, from Fidelity to Merrill Lynch to Envestnet, he knows how firms and clients interact—and how to make it better.

Mike Young

head of product

A senior product and design leader with more than a decade shaping digital experiences at Merrill, he brings institutional product rigor to Truthifi.

Nathan Knight

head of engineering

Trained in computer science at the University of Waterloo and battle-tested at ConsenSys, he has built and owned several complex systems end to end.

Leadership

Built by people who know financial systems.

Scott Blandford

ceo & founder

After 25 years at TIAA, Fidelity, and Merrill, he founded Truthifi to make the global investment system legible for the first time.

Rich Aneser

strategy & partnerships

Having led strategy and marketing for 25+ years, from Fidelity to Merrill Lynch to Envestnet, he knows how firms and clients interact—and how to make it better.

Mike Young

head of product

A senior product and design leader with more than a decade shaping digital experiences at Merrill, he brings institutional product rigor to Truthifi.

Nathan Knight

head of engineering

Trained in computer science at the University of Waterloo and battle-tested at ConsenSys, he has built and owned several complex systems end to end.

Leadership

Built by people who know financial systems.

Scott Blandford

ceo & founder

After 25 years at TIAA, Fidelity, and Merrill, he founded Truthifi to make the global investment system legible for the first time.

Rich Aneser

strategy & partnerships

Having led strategy and marketing for 25+ years, from Fidelity to Merrill Lynch to Envestnet, he knows how firms and clients interact—and how to make it better.

Mike Young

head of product

A senior product and design leader with more than a decade shaping digital experiences at Merrill, he brings institutional product rigor to Truthifi.

Nathan Knight

head of engineering

Trained in computer science at the University of Waterloo and battle-tested at ConsenSys, he has built and owned several complex systems end to end.

Our advisors

Roger Ferguson

Former Fed Vice Chair, CEO TIAA

Steve Jenks

CMO, Empower

Bill Crager

CEO, Founded Envestnet

Anton Honikman

CEO MyVest

Dan Petrozzo

Serial founder, VC, Goldman & Fidelity CIO

Our advisors

Roger Ferguson

Former Fed Vice Chair, CEO TIAA

Steve Jenks

CMO, Empower

Bill Crager

CEO, Founded Envestnet

Anton Honikman

CEO MyVest

Dan Petrozzo

Serial founder, VC, Goldman & Fidelity CIO

Our advisors

Roger Ferguson

Former Fed Vice Chair, CEO TIAA

Steve Jenks

CMO, Empower

Bill Crager

CEO, Founded Envestnet

Anton Honikman

CEO MyVest

Dan Petrozzo

Serial founder, VC, Goldman & Fidelity CIO

See every household. Empower every advisor.

800,000,000+

Monitored

18,000+

Providers covered

Bank-grade

Security

Who we serve

Company

Legal

See every household. Empower every advisor.

800,000,000+

Monitored

18,000+

Providers covered

Bank-grade

Security

Who we serve

Company

Legal

See every household. Empower every advisor.

800,000,000+

Monitored

18,000+

Providers covered

Bank-grade

Security

Who we serve

Company

Legal