FOR FINTECHS & ENTERPRISES

Become the center of your clients’ financial lives. Not just another account.

One unified view of clients’ full financial lives

Daily-use intelligence—not static PFM

Actionable AI intelligence

Deeper engagement = more revenue

FOR FINTECHS & ENTERPRISES

Become the center of your clients’ financial lives. Not just another account.

One unified view of clients’ full financial lives

Daily-use intelligence—not static PFM

Actionable AI intelligence

Deeper engagement = more revenue

FOR FINTECHS & ENTERPRISES

Become the center of your clients’ financial lives. Not just another account.

One unified view of clients’ full financial lives

Daily-use intelligence—not static PFM

Actionable AI intelligence

Deeper engagement = more revenue

The challenge

Your clients have many accounts. How often do they log in to yours?

10-12

Number of held-away accounts in the average household

Source: synthesis of Federal Reserve Survey of Consumer Finances, FDIC, and Experian data

54%

Average assets held-away from primary provider

Source: Digital banking engagement studies

78%

of consumers want a unified view, but only 29% have one

Source: Industry digital banking research

The challenge

Your clients have many accounts. How often do they log in to yours?

10-12

Number of held-away accounts in the average household

Source: synthesis of Federal Reserve Survey of Consumer Finances, FDIC, and Experian data

54%

Average assets held-away from primary provider

Source: Digital banking engagement studies

78%

of consumers want a unified view, but only 29% have one

Source: Industry digital banking research

The challenge

Your clients have many accounts. How often do they log in to yours?

10-12

Number of held-away accounts in the average household

Source: synthesis of Federal Reserve Survey of Consumer Finances, FDIC, and Experian data

54%

Average assets held-away from primary provider

Source: Digital banking engagement studies

78%

of consumers want a unified view, but only 29% have one

Source: Industry digital banking research

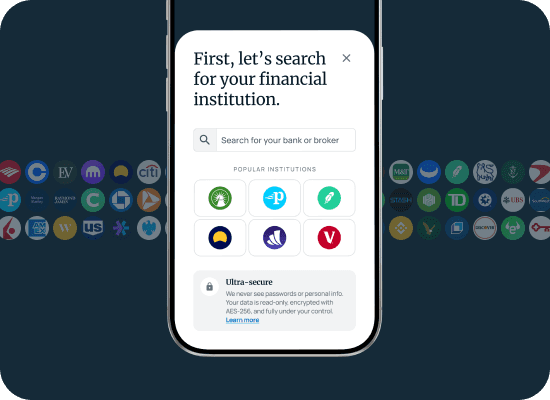

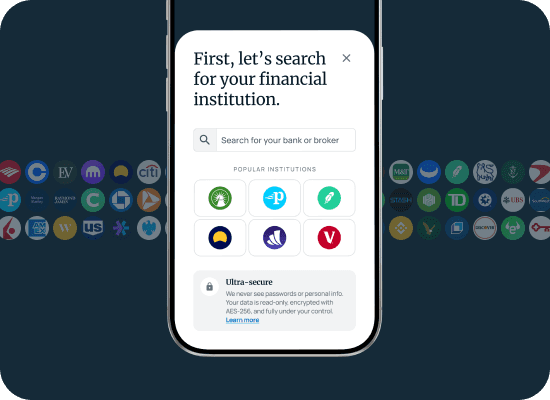

How it works

From account holder to financial hub.

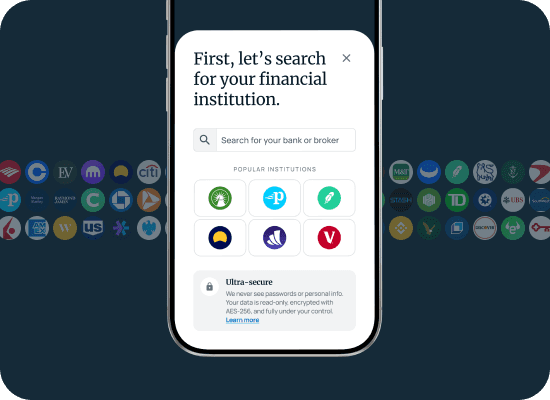

1

Connect.

Clients link external accounts in moments.

2

Understand.

Truthifi analyzes the full financial picture continuously.

3

Engage

Clients receive insights that drive repeat usage.

4

Deepen.

Surface timely, relevant product opportunities.

How it works

From account holder to financial hub.

1

Connect.

Clients link external accounts in moments.

2

Understand.

Truthifi analyzes the full financial picture continuously.

3

Engage

Clients receive insights that drive repeat usage.

4

Deepen.

Surface timely, relevant product opportunities.

How it works

From account holder to financial hub.

1

Connect.

Clients link external accounts in moments.

2

Understand.

Truthifi analyzes the full financial picture continuously.

3

Engage

Clients receive insights that drive repeat usage.

4

Deepen.

Surface timely, relevant product opportunities.

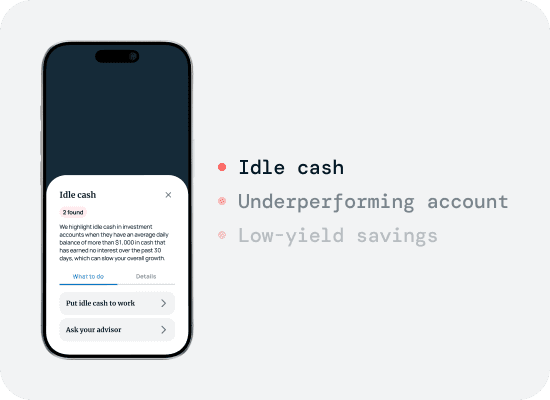

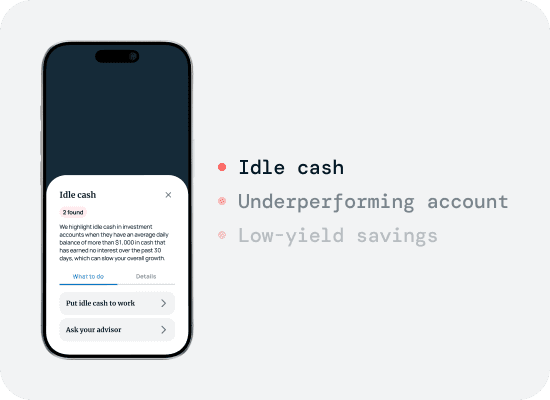

What we deliver

You become the trusted home for your clients’ complete financial picture.

Complete financial picture.

Clients connect all their accounts—yours and everyone else’s—and see everything in one place, updated automatically.

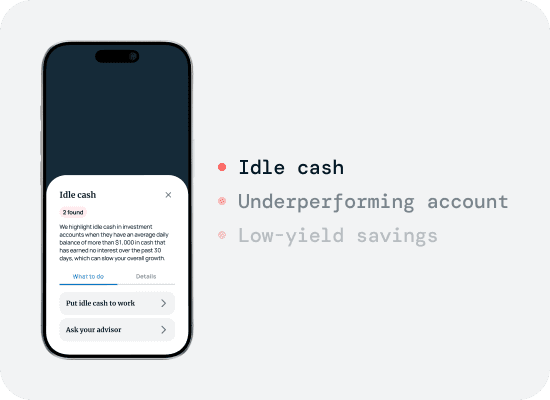

Engaging insights

100+ diagnostics surface insights clients act on: fees, allocation drift, spending patterns, and progress toward goals.

Win more share

Drive additional product usage and cross-sell revenue

Automated nudges = less work.

Automated alerts and the monthly podcast statement—fully branded—keep clients engaged without adding operational burden.

What we deliver

You become the trusted home for your clients’ complete financial picture.

Complete financial picture.

Clients connect all their accounts—yours and everyone else’s—and see everything in one place, updated automatically.

Engaging insights

100+ diagnostics surface insights clients act on: fees, allocation drift, spending patterns, and progress toward goals.

Win more share

Drive additional product usage and cross-sell revenue

Automated nudges = less work.

Automated alerts and the monthly podcast statement—fully branded—keep clients engaged without adding operational burden.

What we deliver

You become the trusted home for your clients’ complete financial picture.

Complete financial picture.

Clients connect all their accounts—yours and everyone else’s—and see everything in one place, updated automatically.

Engaging insights

100+ diagnostics surface insights clients act on: fees, allocation drift, spending patterns, and progress toward goals.

Win more share

Drive additional product usage and cross-sell revenue

Automated nudges = less work.

Automated alerts and the monthly podcast statement—fully branded—keep clients engaged without adding operational burden.

The truthifi® advantage

Your platform, their primary financial home.

2x higher account link rates

Users connect twice as many accounts to Truthifi compared to traditional aggregation tools.

Continuous household visibility

Once accounts are linked, Truthifi monitors them continuously—not just at onboarding or review time.

100+ consumer-friendly diagnostics

100+ AI-powered diagnostics turn held-away data into actions across performance, concentrations, and more.

White-labeled, native experiences

Your brand with better insights, better meetings, and better outcomes—and less work.

The truthifi® advantage

Your platform, their primary financial home.

2x higher account link rates

Users connect twice as many accounts to Truthifi compared to traditional aggregation tools.

Continuous household visibility

Once accounts are linked, Truthifi monitors them continuously—not just at onboarding or review time.

100+ consumer-friendly diagnostics

100+ AI-powered diagnostics turn held-away data into actions across performance, concentrations, and more.

White-labeled, native experiences

Your brand with better insights, better meetings, and better outcomes—and less work.

The truthifi® advantage

Your platform, their primary financial home.

2x higher account link rates

Users connect twice as many accounts to Truthifi compared to traditional aggregation tools.

Continuous household visibility

Once accounts are linked, Truthifi monitors them continuously—not just at onboarding or review time.

100+ consumer-friendly diagnostics

100+ AI-powered diagnostics turn held-away data into actions across performance, concentrations, and more.

White-labeled, native experiences

Your brand with better insights, better meetings, and better outcomes—and less work.

When clients see their entire financial life through your lens, your institution becomes their financial home.

When clients see their entire financial life through your lens, your institution becomes their financial home.

When clients see their entire financial life through your lens, your institution becomes their financial home.

Leadership

Built by people who know financial systems.

Scott Blandford

ceo & founder

After 25 years at TIAA, Fidelity, and Merrill, he founded Truthifi to make the global investment system legible for the first time.

Rich Aneser

strategy & partnerships

Having led strategy and marketing for 25+ years, from Fidelity to Merrill Lynch to Envestnet, he knows how firms and clients interact—and how to make it better.

Mike Young

head of product

A senior product and design leader with more than a decade shaping digital experiences at Merrill, he brings institutional product rigor to Truthifi.

Nathan Knight

head of engineering

Trained in computer science at the University of Waterloo and battle-tested at ConsenSys, he has built and owned several complex systems end to end.

Leadership

Built by people who know financial systems.

Scott Blandford

ceo & founder

After 25 years at TIAA, Fidelity, and Merrill, he founded Truthifi to make the global investment system legible for the first time.

Rich Aneser

strategy & partnerships

Having led strategy and marketing for 25+ years, from Fidelity to Merrill Lynch to Envestnet, he knows how firms and clients interact—and how to make it better.

Mike Young

head of product

A senior product and design leader with more than a decade shaping digital experiences at Merrill, he brings institutional product rigor to Truthifi.

Nathan Knight

head of engineering

Trained in computer science at the University of Waterloo and battle-tested at ConsenSys, he has built and owned several complex systems end to end.

Leadership

Built by people who know financial systems.

Scott Blandford

ceo & founder

After 25 years at TIAA, Fidelity, and Merrill, he founded Truthifi to make the global investment system legible for the first time.

Rich Aneser

strategy & partnerships

Having led strategy and marketing for 25+ years, from Fidelity to Merrill Lynch to Envestnet, he knows how firms and clients interact—and how to make it better.

Mike Young

head of product

A senior product and design leader with more than a decade shaping digital experiences at Merrill, he brings institutional product rigor to Truthifi.

Nathan Knight

head of engineering

Trained in computer science at the University of Waterloo and battle-tested at ConsenSys, he has built and owned several complex systems end to end.

Our advisors

Roger Ferguson

Former Fed Vice Chair, CEO TIAA

Steve Jenks

CMO, Empower

Bill Crager

CEO, Founded Envestnet

Anton Honikman

CEO MyVest

Dan Petrozzo

Serial founder, VC, Goldman & Fidelity CIO

Our advisors

Roger Ferguson

Former Fed Vice Chair, CEO TIAA

Steve Jenks

CMO, Empower

Bill Crager

CEO, Founded Envestnet

Anton Honikman

CEO MyVest

Dan Petrozzo

Serial founder, VC, Goldman & Fidelity CIO

Our advisors

Roger Ferguson

Former Fed Vice Chair, CEO TIAA

Steve Jenks

CMO, Empower

Bill Crager

CEO, Founded Envestnet

Anton Honikman

CEO MyVest

Dan Petrozzo

Serial founder, VC, Goldman & Fidelity CIO

Become the financial home your members rely on.

$800,000,000+

Monitored

18,000+

Providers covered

Bank-grade

Security

Who we serve

Company

Legal

Become the financial home your members rely on.

$800,000,000+

Monitored

18,000+

Providers covered

Bank-grade

Security

Who we serve

Company

Legal

Become the financial home your members rely on.

$800,000,000+

Monitored

18,000+

Providers covered

Bank-grade

Security

Who we serve

Company

Legal